All Categories

Featured

Table of Contents

TIAA might provide a Loyalty Incentive that is just available when electing lifetime earnings. Annuity contracts might contain terms for keeping them in pressure. TIAA Typical is a set annuity product issued via these agreements by Educators Insurance coverage and Annuity Association of America (TIAA), 730 Third Opportunity, New York, NY, 10017: Kind collection consisting of but not restricted to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8 (rate of return for annuity).

Converting some or every one of your cost savings to earnings advantages (referred to as "annuitization") is an irreversible choice. As soon as revenue benefit repayments have started, you are not able to change to an additional alternative. A variable annuity is an insurance contract and includes underlying financial investments whose value is tied to market efficiency.

Annuity System Definition

When you retire, you can select to get revenue permanently and/or other revenue choices. The property sector is subject to numerous threats consisting of fluctuations in underlying building worths, expenditures and income, and prospective ecological obligations. As a whole, the worth of the TIAA Property Account will certainly rise and fall based on the underlying value of the direct real estate, genuine estate-related investments, genuine estate-related securities and fluid, fixed earnings investments in which it spends.

For a much more full discussion of these and various other threats, please speak with the syllabus. Accountable investing includes Environmental Social Governance (ESG) variables that may affect exposure to companies, sectors, industries, limiting the kind and number of financial investment possibilities offered, which could lead to leaving out financial investments that do well. There is no warranty that a diversified portfolio will improve general returns or outmatch a non-diversified profile.

Fixed Annuity Characteristics

Accumulation Bond Index was -0.20 and -0.36, respectively. Over this very same duration, relationship in between the FTSE Nareit All Equity REIT Index and the S&P 500 Index was 0.77. You can not spend straight in any kind of index. Index returns do not mirror a deduction for charges and expenses. 8 Other payment alternatives are readily available.

10 TIAA may proclaim additional amounts of interest and revenue benefits over contractually ensured degrees. Added quantities are not ensured past the period for which they are declared. 11 Transforming some or every one of your cost savings to earnings benefits (referred to as "annuitization") is an irreversible decision. When revenue benefit settlements have actually begun, you are unable to transform to another option.

Nevertheless, it's crucial to keep in mind that your annuity's balance will be lowered by the income payments you get, independent of the annuity's performance. Revenue Test Drive revenue payments are based upon the annuitization of the amount in the account, duration (minimum of ten years), and various other aspects picked by the individual.

Annuitization is unalterable. Any kind of assurances under annuities issued by TIAA undergo TIAA's claims-paying ability. Interest over of the ensured quantity is not guaranteed for durations besides the durations for which it is declared.

Scan today's listings of the ideal Multi-year Guaranteed Annuities - MYGAs (updated Sunday, 2024-12-01). For professional assistance with multi-year ensured annuities call 800-872-6684 or click a 'Get My Quote' button next to any annuity in these listings.

Postponed annuities enable an amount to be taken out penalty-free. Deferred annuities usually allow either penalty-free withdrawals of your earned interest, or penalty-free withdrawals of 10% of your agreement worth each year.

Annuity Buyout Offers

The earlier in the annuity duration, the greater the charge portion, referred to as abandonment costs. That's one factor why it's best to stick with the annuity, as soon as you commit to it. You can take out every little thing to reinvest it, but before you do, ensure that you'll still prevail by doing this, also after you figure in the abandonment charge.

The surrender charge might be as high as 10% if you surrender your contract in the first year. An abandonment cost would certainly be charged to any withdrawal better than the penalty-free quantity enabled by your postponed annuity agreement.

You can set up "organized withdrawals" from your annuity. Your various other alternative is to "annuitize" your postponed annuity.

Lots of deferred annuities enable you to annuitize your contract after the initial agreement year. Passion made on CDs is taxed at the end of each year (unless the CD is held within tax certified account like an IRA).

The interest is not strained up until it is eliminated from the annuity. In other words, your annuity grows tax deferred and the interest is worsened each year.

Prior to pulling cash out of a MYGA early, consider that one of the significant benefits of a MYGA is that they expand tax-deferred. Chris Magnussen, accredited insurance coverage agent at Annuity (cashing in an annuity after death).org, clarifies what a repaired annuity is. A MYGA supplies tax deferment of interest that is compounded on an annual basis

Retirement Annuity Withdrawal

It's like purchasing an individual retirement account or 401(k) yet without the contribution limits. The tax policies modification a little depending on the sort of funds you make use of to buy the annuity. If you purchase a MYGA with certified funds, such through an IRA or other tax-advantaged account, you pay earnings tax on the principal and rate of interest when you secure money, according to CNN Money.

It exists with traditional set annuities. The main difference between traditional set annuities and MYGAs is the period of time that the agreements ensure the fixed interest price.

So, you might acquire an annuity with a seven-year term yet the rate may be guaranteed just for the very first 3 years. When individuals talk of MYGAs, they usually liken them to CDs. Discover just how to protect your nest egg from market volatility. Both MYGAs and CDs deal ensured price of return and a guaranty on the principal.

Compared to financial investments like stocks, CDs and MYGAs are more secure yet the rate of return is reduced. A CD is released by a financial institution or a broker; a MYGA is an agreement with an insurance policy firm.

Annuity Advertising

A CD may have a reduced rate of interest price than a MYGA; a MYGA might have more costs than a CD. CD's might be made available to lenders and liens, while annuities are shielded against them.

Offered the conservative nature of MYGAs, they may be better for consumers closer to retired life or those that like not to be based on market volatility. "I turn 62 this year and I actually want some kind of a set rate as opposed to bothering with what the stock market's mosting likely to carry out in the following one decade," Annuity.org customer Tracy Neill stated.

For those who are seeking to surpass rising cost of living, a MYGA may not be the very best economic approach to satisfy that goal. If you are looking for an option to change your earnings upon retirement, other sorts of annuities might make more sense for your economic goals. In addition, other kinds of annuities have the possibility for higher incentive, but the threat is higher, too.

Better understand the actions entailed in purchasing an annuity. They use modest returns, they are a secure and dependable financial investment option.

Prior to drawing cash out of a MYGA early, take into consideration that one of the significant advantages of a MYGA is that they expand tax-deferred. Chris Magnussen, accredited insurance coverage representative at Annuity.org, discusses what a repaired annuity is. A MYGA offers tax obligation deferment of passion that is intensified on an annual basis.

It's like investing in an Individual retirement account or 401(k) yet without the contribution restrictions.

Flexible Premium Indexed Annuity

It exists with typical fixed annuities. The primary difference between standard set annuities and MYGAs is the period of time that the agreements ensure the set rate of interest rate.

You might purchase an annuity with a seven-year term however the rate might be ensured just for the first 3 years. Discover how to safeguard your nest egg from market volatility.

Compared to financial investments like supplies, CDs and MYGAs are safer but the rate of return is reduced - variable annuity funds. A CD is released by a financial institution or a broker; a MYGA is an agreement with an insurance coverage business.

A CD may have a reduced interest rate than a MYGA; a MYGA might have a lot more charges than a CD. CD's might be made available to financial institutions and liens, while annuities are safeguarded against them.

Offered the conventional nature of MYGAs, they could be better suited for consumers closer to retirement or those that choose not to be subjected to market volatility. "I turn 62 this year and I actually want some kind of a fixed rate instead of fretting about what the stock market's going to perform in the next ten years," Annuity.org customer Tracy Neill stated.

Myg Annuity

For those that are looking to outmatch inflation, a MYGA might not be the most effective economic strategy to fulfill that goal. If you are searching for an option to replace your income upon retirement, other sorts of annuities might make even more sense for your economic goals. Furthermore, other types of annuities have the potential for higher benefit, yet the risk is higher, too.

Better comprehend the actions entailed in purchasing an annuity. Multi-year guaranteed annuities are a sort of taken care of annuity that deal guaranteed prices of return without the risk of securities market volatility. Though they use moderate returns, they are a safe and trustworthy financial investment alternative. A market value change is a function an annuity provider might consist of to safeguard itself versus losses in the bond market.

Table of Contents

Latest Posts

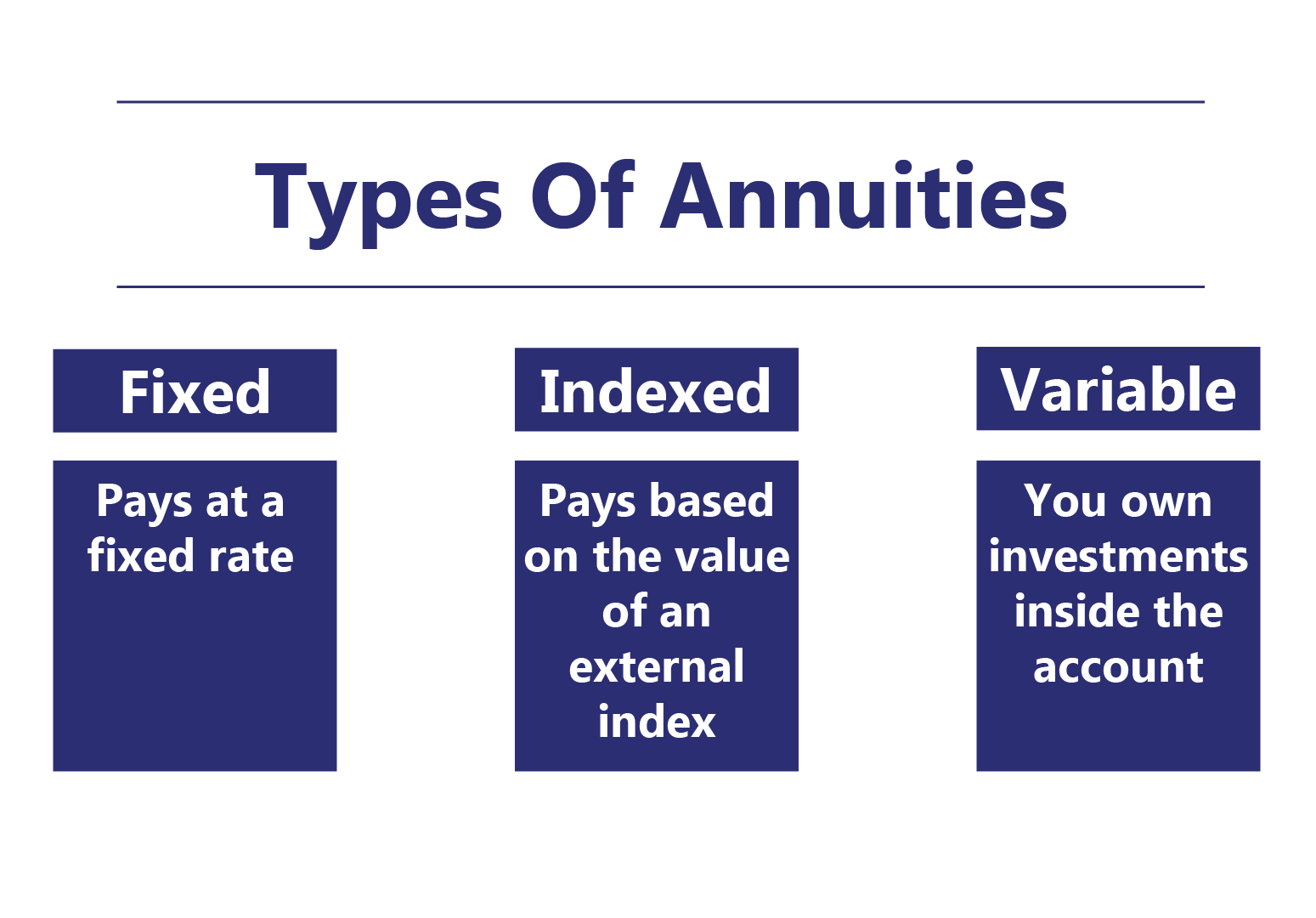

Highlighting Annuity Fixed Vs Variable A Closer Look at Variable Vs Fixed Annuities What Is Variable Annuities Vs Fixed Annuities? Advantages and Disadvantages of Pros And Cons Of Fixed Annuity And Va

Understanding Fixed Annuity Vs Variable Annuity Key Insights on Your Financial Future Defining Variable Annuity Vs Fixed Indexed Annuity Benefits of Fixed Annuity Vs Variable Annuity Why Choosing the

Understanding Financial Strategies Everything You Need to Know About Financial Strategies What Is Annuity Fixed Vs Variable? Advantages and Disadvantages of Different Retirement Plans Why Fixed Annuit

More

Latest Posts